First of all, we would like to wish you a Very Merry Christmas and Happy New Year.

Please find attached some comments on where we think the markets will go in Q1 2014. Information is from a variety of sources including suppliers. These are just indications rather than exact predictions.

If you have any comments or we can help with anything else, please let us know.

Methanol:

The Northwest European Methanol contract price for Q1 2014 was settled late last week, up €37/mt from Q4 2013. Initial market reactions saw the increase as reasonable with one market participant saying "I think it was the fairest settlement we have had in four quarters." Tightness in the methanol market has continued throughout 2013, and does not really show any signs of diminishing. The main reasons for the tightness have been outages at major producer sites and feedstock curtailments in the main production areas, combined with the inability to bring Iranian product into US or Europe. There has been no real fall-off in demand despite the higher selling ideas, and that has led to an extremely snug market, with spot prices reaching levels not seen for 5 years. The Q1 ECP is also the highest since early 2008.

Acetic Acid & Acetyls

Due to the price increases of methanol and natural gas, producers have increased the Acetic Acid price by €30 per tonne for Q1 2014. As you can see from the attached slide, both gas and methanol have been on a relentless increase for the last couple of years. BP announced that they had developed a new Acetic Acid technology which could be the biggest breakthrough in acetic acid technology in the past 40 years.

VAM: Celanese have announced the closure of its VAM plant in Tarragona, Spain following on the closure of the INEOS plant in the UK. This will add further pressure to VAM prices during 2014

Ethanol:

There have been some upwards movements in the Ethylene contract price during Q4 and into Q1 2014. Producers have applied these increases on other ethylene based derivatives but Ethanol is expected to remain stable for Q1 2014. Many US producers have cut production rates or idled plants as a result of higher feedstock costs (corn) and this will result in higher Ethanol prices in the US. High quality synthetic material remains tight and this situation will continue through 2013-14. SASOL had announced closure of its HERNE, Germany synthetic Ethanol plant in November. However INEOS has agreed to purchase Sasol Solvents Germany GmbH. The acquisition is subject to approval by the relevant competition regulators. SASOL's Moers site produces isopropyl alcohol (IPA) and secondary butyl alcohol (SBA), which is upgraded on site into methyl ethyl ketone (MEK). SASOL's Herne site manufactures ethanol and isopropyl alcohol.

Ethyl Acetate:

Even though Europe is structurally short on Ethyl Acetate, as it is limited to only one major local producer, regular imports are expected to continue from India and Brazil and keep the market balanced. Prices have remained relatively stable during Q4 despite higher feedstock costs as suppliers try to gain market share. Q1 expectation is continuing stability but producers may try and push through an increase based on increasing feedstock (€15-40).

Butyl Acetate market is balanced although prices have increased slightly. Further increases due to raw materials could be seen in Q1 3014.

Isopropanol

IPA demand is expected to increase in Q1 due to seasonal de-icing requirement and prices will increase on the back of propylene increases. Prices are expected to follow the same pattern as 2013.

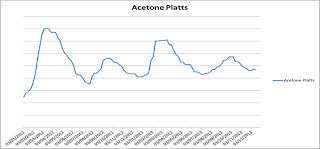

Acetone & Ketones

Acetone market and prices are driven by Phenol production (co-product). Phenol production rates are running at c.65-70% as demand is quoted as stagnant. The key raw material, Benzene, is in balanced supply but there is pressure to increase prices. Acetone prices are expected to follow the same pattern as 2012 but from a higher base, therefore price increases are expected as supply tightens. New Acetone builds planned in Asia will not affect the European market. Pharmacopeia grade Acetone is said to carry a 10-20% premium over normal-grade acetone.

MEK/MIBK demand has improved. Prices are expected to increase slightly going into Q1.

Toluene, Hydrocarbons and White Spirits

European Hydrocarbons and aromatics will continue to remain volatile and prices could continue on their bumpy road. Lighter crude feedstock into crackers has reduced output and Toluene was diverted into producing Benzene. While there have been fewer imports into Europe and Toluene, Xylene and other hydrocarbons have fallen in price since the start of 2013 but increases of 5-8% are expected going into Q1 2014.

Mono Ethylene Glycol (MEG)

MEG prices have started to increase again as the seasonal demand kicks in and ethylene raw material increases. European trade sanctions against IRAN have resulted in reduced imports and some plant closures.

THF (Tetra Hydro Furan)

New capacity in Asia has yet to come on stream. Prices decreased slightly during Q4 and are expected to remain stable going into 2014. The new global capacity may lead to price reductions during 2014.

Acetonitrile

Acetonitrile is a co-product in the production of Acrylonitrile and needs to be purified to remove high levels of Hydrogen Cyanide. This is normally done alongside the Acrylonitrile production unit as crude Acetonitrile is difficult to transport because of the HCN content. Most Acrylonitrile plants actually burn the crude Acetonitrile rather than purify it. Once purified the Acetonitrile output is approximately 2.5-3% of Acrylonitrile output and consequently the Acetonitrile supply/demand balance is totally governed by Acrylonitrile output. Acrylonitrile demand is very weak and needs a global economic recovery. This will result in a tightening supply as producers reduce output, which in turn could tighten the Acetonitrile market.

Methylene Chloride

All plants are running normally and no major changes are expected at this time.

AdBlue® Urea Solution and Automotive Products

Urea prices have increased during Q4 from low level in Q3. Further increase are expected in Q1 as the export window from China closes which will then see an increase level of prices for AdBlue® Urea Solution.

As mentioned in our previous commentaries, we are producing Adblue® under our BlueCat® trademark. Adblue® is required in all new trucks using SCR technology to reduce NOx emissions. We are the only licensed Irish manufacturer of this product, and we have begun producing product in Australia through a franchise partner.

Other News Items

Brockley Group (Eirchem) now has added TOLUENE from ESSAR OIL (Formerly Shell Stanlow) to their portfolio of products and principals. If you require more information please contact me.

Q1 2014 will continue an exciting period for Brockley as many new developments come on stream:

¨ Our new AdBlue® plant will be commissioned of which will more than double our capacity.

¨ We will move our depot into a new purpose built warehouse on Johnston Logistics site.

¨ Our new web-based accounts package will go live.

If you require any product or catalysts, please call us and we will try to source it for you.

Patrick Short

23rd December 2013

Best Regards

Pat Short

Brockley Group

Mob: +353 87 2426720

Tel: + 353 1 8392016

www.brockleygroup.com

www.bluecat.ie

No comments:

Post a Comment